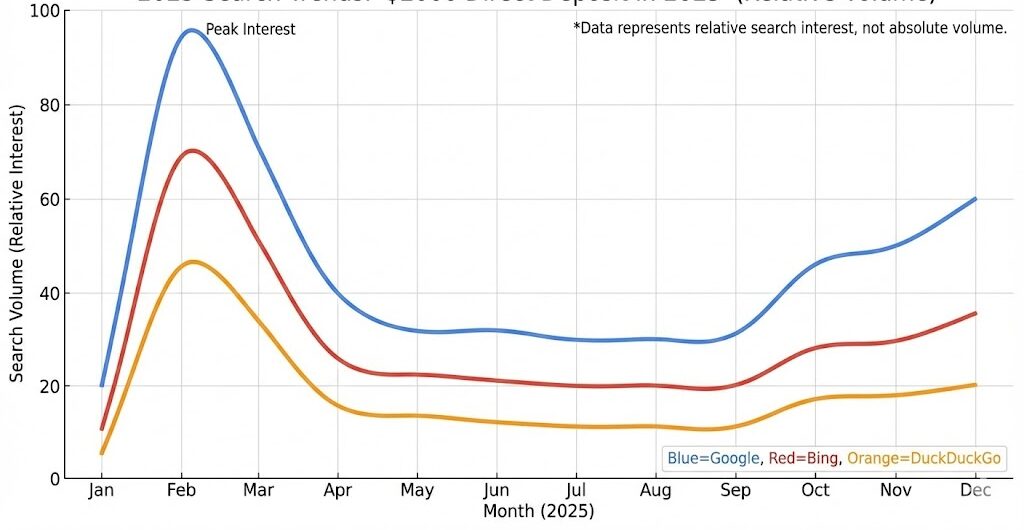

The $2000 Direct Deposit in 2025 has become the center of widespread online speculation, prompting federal officials to warn the public that no such stimulus program has been approved. The Internal Revenue Service (IRS) says no payments have been authorized and no eligibility or claiming instructions exist, despite a surge of reports circulating on social media and low-credibility websites.

$2000 Direct Deposit in 2025

| Key Fact | Detail |

|---|---|

| No federal program approved | Congress has passed no 2025 relief bill authorizing new payments. |

| IRS has issued no instructions | No payment schedule, eligibility rules, or claiming process exists. |

| Fraud risks increasing | Consumer agencies warn of rising scams linked to benefit rumors. |

While speculation about a $2000 Direct Deposit in 2025 continues across social media, federal agencies confirm that no payment has been approved and no instructions for eligibility or claiming exist. Analysts say similar rumors are likely to persist unless economic conditions improve or lawmakers provide clear public statements about any future relief efforts.

Federal Agencies Deny Existence of $2000 Direct Deposit in 2025

Federal officials are responding to mounting public confusion about the $2000 Direct Deposit in 2025, a payment widely discussed online but not backed by any legislation or government announcement.

In a written statement, an IRS spokesperson said the agency is “not issuing new stimulus payments in 2025, and no eligibility criteria or claiming procedures have been published for any new federal relief initiative.”

Officials from the Senate Finance Committee echoed the clarification, confirming that no bill introducing a universal $2,000 payment for 2025 has been submitted, debated, or scheduled for legislative review.

Researchers at the Pew Research Center say the rapid spread of unverified claims highlights growing challenges in public access to accurate financial information, particularly during periods of inflation and political tension.

Why the Rumor Gained Traction

A Confusing Blend of Old and New Information

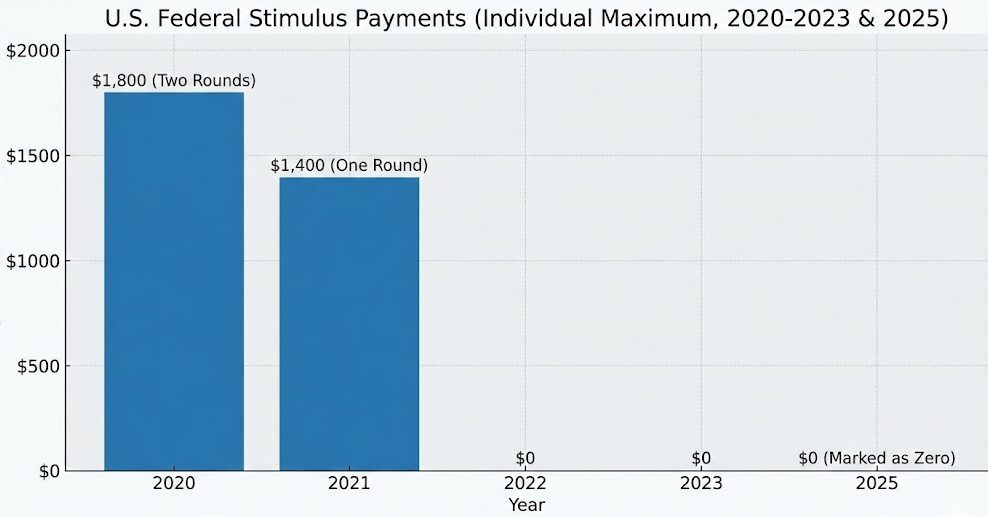

Much of the misinformation stems from outdated references to pandemic-era stimulus programs, including the Economic Impact Payments administered in 2020 and 2021. Some online posts also misinterpret state-level rebates—such as those in California, Colorado, and New Mexico—as federal programs.

“These claims often combine fragments of real programs with fabricated details, creating a convincing but inaccurate narrative,” said Dr. Elena Martinez, a public policy professor at the University of California.

Election-Year Misrepresentation

Economists note that unfounded claims about federal payments tend to surge during election cycles, when candidates’ statements are frequently distorted or exaggerated online.

“People are more likely to believe relief is coming when economic pressure is high and political messaging is loud,” said Dr. Henry Wells, a senior economist at the University of Michigan.

How Previous Stimulus Payments Worked

To understand why the $2000 Direct Deposit in 2025 rumor persists, it helps to review how federal stimulus checks were actually issued in the past.

Pandemic-Era Stimulus Payments (2020–2021)

Congress approved three rounds of direct payments:

- $1,200 in March 2020

- $600 in December 2020

- $1,400 in March 2021

Each required:

- Passage of a federal relief bill

- Presidential approval

- IRS technical readiness

- Treasury funding authorization

None of these steps have occurred in 2025.

Why 2022–2024 Payments Did Not Happen

Post-pandemic relief proposals stalled due to:

- Declining political support for broad stimulus

- Concern over inflation

- Shifts toward targeted tax credits instead of universal checks

These political dynamics remain unchanged today.

How Federal Payments Are Authorized: A Step-by-Step Breakdown

Understanding the approval process helps clarify why no $2000 Direct Deposit in 2025 exists.

Step 1: Legislation Introduced

A member of Congress must submit a bill proposing:

- The payment amount

- Eligibility guidelines

- Program funding

No such bill exists for 2025.

Step 2: Committee Review

The House Ways and Means Committee or the Senate Finance Committee must evaluate it.

Committee staff confirm no hearings or markups are scheduled.

Step 3: Full Chamber Vote

The bill must pass both chambers.

Step 4: Presidential Signature

Only then can the IRS begin implementing payments.

“Without congressional action, no federal agency has the legal authority to issue a new core stimulus check,” said Mark Jefferson, a former Treasury Department adviser.

IRS Says No Eligibility Rules or Claiming Instructions Exist

A Common Source of Misinformation

Many online posts list supposed “Full Eligibility” criteria—including income thresholds, residency rules, or benefit status. These lists often mirror outdated rules from prior stimulus programs and bear no resemblance to current tax law.

The IRS confirms:

- No eligibility criteria have been drafted

- No application or claiming systems exist

- No guidance has been published

IRS Fraud Division Issues Warnings

The agency warns taxpayers not to submit personal documents or bank information to unofficial websites claiming to “register” individuals for the $2000 payment.

“Scammers often use fabricated federal programs to obtain Social Security numbers and financial data,” the IRS Fraud Enforcement Office said in a recent alert.

Economic Conditions Driving Public Interest in the Rumored Payment

Many Americans continue to face financial pressure, making the idea of a new federal payment appealing—even without evidence that one exists.

Rising Living Costs

According to the U.S. Bureau of Labor Statistics:

- Housing costs rose sharply in 2024–2025

- Food prices remain above pre-pandemic levels

- Wage growth slowed across several sectors

These economic conditions help fuel public belief in unofficial relief claims.

Impact on Seniors and Fixed-Income Households

Older adults receiving Social Security or Supplemental Security Income (SSI) are often targeted by misinformation because their fixed benefits offer little flexibility.

“Seniors are disproportionately affected by financial misinformation campaigns,” said Karen Doyle, a cybersecurity analyst at the Federal Trade Commission (FTC).

How to Verify Any Future Federal Payment Program

Experts say misinformation will continue to circulate as people seek financial certainty. To counter this, public agencies recommend several verification strategies:

1. Check Official Government Websites

Reliable federal information must originate from:

- IRS.gov

- Treasury.gov

- Congress.gov

- SSA.gov

No other source should be considered authoritative.

2. Watch for Consistent Cross-Agency Messaging

Official programs are always announced in multiple places—not through a single website or viral video.

3. Confirm Media Coverage from Credible Outlets

Major news organizations such as Reuters, The Associated Press, and The Wall Street Journal report on all significant economic policy changes.

4. Avoid “Registration” Links

The federal government never requires advance registration for stimulus payments.

5. Use IRS Tools Carefully

The IRS offers secure tools such as:

- “Where’s My Refund?”

- Online account management

- Electronic filing status check

None currently include information about the alleged $2000 Direct Deposit in 2025.

Why Misinformation Spreads During Economic Uncertainty

Social scientists point to several consistent drivers:

Algorithmic Amplification

False claims spread more quickly due to engagement-based ranking on major platforms.

Economic Anxiety

High living costs make relief-related content especially compelling.

Credibility Illusions

Repetition and the use of official-sounding language create a false sense of legitimacy.

Low Financial Literacy

Studies show that many Americans lack familiarity with federal budgeting and stimulus processes.

First Social Security Payments Arrive in Just Days: Countdown to December Benefits

“Misinformation grows when there is a vacuum of official information, even when nothing is happening,” said Dr. Paula Riggs, a behavioral economist at the RAND Corporation.

What Happens Next

If Congress ever proposes a new payment in 2025, early signs would include:

- Bill filings

- Public hearings

- Budget analyses

- Statements from Treasury and IRS officials

None of these steps are in progress.

For now, the IRS urges taxpayers to rely only on verified federal announcements and to report suspicious messages to the FTC Fraud Reporting Center.