Lawmakers are advancing a proposal to implement a $200 Social Security Boost for millions of Americans starting in 2026. The six-month increase would temporarily raise benefits for retirees, disabled workers, and survivors as they face persistent inflation and rising medical costs. Supporters say the measure offers meaningful short-term relief, while critics argue it fails to address long-term solvency concerns within the Social Security system.

$200 Social Security Boost

| Key Fact | Detail |

|---|---|

| Proposed boost | $200 added to monthly Social Security benefits for six months |

| Projected 2026 COLA | About 2.8% |

| Eligible groups | Retirees, SSDI, survivors, SSI, veterans’ beneficiaries |

| Estimated cost | Several billion dollars in 2026 |

| Major concern | Temporary relief does not address long-term solvency |

| Official Website | Social Security Administration |

What the Proposed $200 Social Security Boost Would Do

The proposal would temporarily raise monthly Social Security benefits by $200 for six months in 2026. The money would be added on top of the standard annual cost-of-living adjustment (COLA), which the Social Security Administration (SSA) projects at roughly 2.8% for that year.

This means an average retiree currently receiving $1,900 per month would gain about $56 from COLA and an additional $200 from the temporary supplement—totaling roughly $1,256 over six months.

Senator Elizabeth Warren, a long-time advocate for expanding Social Security, said the measure is designed to “provide older Americans with immediate purchasing power during a period of sustained economic pressure.”

The bill automatically includes SSDI, SSI, survivors’ benefits, and certain federal and railroad retirement programs, ensuring a broad reach across the social safety net.

Why Supporters Say the Boost Is Necessary

Inflation has slowed from record highs in 2022 but remains above pre-pandemic levels for key categories affecting seniors. A Bureau of Labor Statistics (BLS) report shows that healthcare services, medication prices, and long-term care costs continue to outpace the general inflation index.

Dr. Laura Meyers, a senior economist at the Urban Institute, said older adults “experience a different inflation basket than younger Americans, and that basket has been disproportionately affected in recent years.”

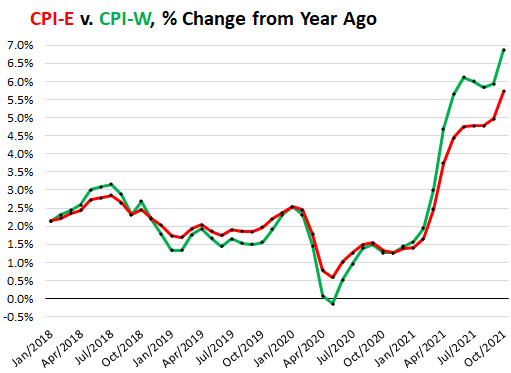

Several advocacy groups argue that the current COLA formula, based on the CPI-W, fails to represent seniors’ expenses. Many prefer the CPI-E, which gives more weight to healthcare and housing.

A temporary boost, they argue, would help offset the financial strain until Congress agrees on broader structural reforms.

The Legislative Path: What Happens Next

The proposal is part of broader Congressional legislation aimed at strengthening the Social Security system for current and future beneficiaries. The bill must pass the Senate Finance Committee before reaching a full Senate vote.

Key lawmakers, including Majority Leader Chuck Schumer, support fast-tracking the temporary benefit increase. Schumer said the proposal “provides meaningful relief to millions while Congress works toward a long-term bipartisan solution.”

However, political dynamics remain complex. Fiscal conservatives have expressed concern about expanding benefits without new revenue sources.

Sen. Chuck Grassley, a Republican member of the Finance Committee, said temporary increases “may help in the short term, but they do not address the basic math facing Social Security’s trust funds.”

A full congressional budget analysis is expected later this year.

Who Would Receive the Additional $200 Payment

The bill covers an estimated 71 million Americans, including:

- Retired workers

- Disabled workers receiving SSDI

- Widow and survivor beneficiaries

- Supplemental Security Income (SSI) recipients

- Railroad and veterans’ beneficiaries

The additional payment would be automatic and would not require beneficiaries to apply.

To prevent unintended consequences, lawmakers included a provision ensuring that the $200 payment does not count as income for federal means-tested programs, including Medicaid, SNAP, and housing assistance.

Experts at the Center on Budget and Policy Priorities say this safeguard is “essential to avoid pushing low-income seniors into ineligibility due to a temporary benefit increase.”

The Big Catch — The Boost Is Temporary

Although the measure would help millions, the six-month duration has drawn criticism.

Dr. Rachel Kim, policy director at the Brookings Institution, said the proposal “acts more like a stimulus than a structural solution,” noting that seniors’ expenses are stable and predictable, not temporary.

Medical cost inflation is expected to continue rising in 2026. According to the Medicare Trustees Report, Medicare Part B premiums are also projected to increase, potentially offsetting part of the temporary payment increase.

Critics warn that once the six-month boost expires, seniors could see their disposable income fall again.

Historical Context — Have Social Security Payments Been Temporarily Increased Before?

Temporary increases are rare but not unprecedented.

- 1972 & 1973: Congress enacted temporary benefit increases before adopting the modern COLA system.

- 2009: Seniors received a one-time $250 stimulus payment during the Great Recession.

- 2020–2021: Congress offered temporary unemployment and stimulus payments, but not Social Security boosts.

The current proposal is unique because it combines a temporary payment boost with ongoing debate about long-term Social Security reform.

How the Boost Fits Into the Broader Debate on Solvency

According to the Social Security Trustees Report, the program’s combined trust funds face projected depletion in the mid-2030s. After that, benefits could be automatically cut by about 20% without congressional action.

Policy analysts offer several possible solutions:

Increase payroll taxes

A proposal endorsed by the Center for Retirement Research at Boston College would raise or eliminate the payroll tax cap on earnings over $168,600.

Raise the retirement age

Some lawmakers propose increasing the full retirement age from 67 to 68 or 69, though critics say such measures disproportionately harm low-income workers.

Adjust COLA formulas

Switching from CPI-W to CPI-E could provide more accurate adjustments but may increase long-term costs.

The proposed $200 boost does not address these solvency questions.

How Recipients Could Use the Extra Funds

Economists say the temporary boost could help older Americans:

- Cover rising prescription costs

- Pay for food and household expenses

- Manage higher utility bills

- Help offset increases in Medicare premiums

- Build emergency savings

A survey by the National Council on Aging found that 45% of respondents would use extra income primarily for medical expenses.

Potential Winners and Losers

Winners

- Low-income seniors heavily burdened by medical costs

- SSI recipients who benefit from income-exempt classification

- Disabled workers facing higher transportation and healthcare expenses

Losers (relative)

- Seniors planning long-term budgets who may misinterpret the boost as permanent

- Policymakers working on long-term solvency, since temporary fixes can delay structural change

Comparing the Proposal to Previous Congressional Attempts

Several past bills proposed larger or permanent increases:

- The Social Security 2100 Act, introduced multiple times since 2019, sought a permanent benefit increase funded by higher payroll taxes on top earners.

- The Boosting Benefits and COLAs for Seniors Act proposed adopting CPI-E and expanding benefits.

- The current proposal is more modest, focusing on short-term relief rather than structural change.

Analysts expect renewed debate on longer-term reform as the 2030s approach.

December 2025 Social Security Payments: The Exact Dates Millions of Retirees Need to Mark Now

What Happens Next

The Senate Finance Committee will review the proposal before deciding whether to advance it. A companion bill is expected in the House, though its prospects are uncertain due to divided party leadership.

Advocates hope the temporary boost will build momentum for broader reforms, while critics argue that stopgap measures may complicate negotiations over long-term solvency.

FAQ About $200 Social Security Boost

Will the $200 Social Security Boost be permanent?

No. The proposal offers only six months of increased payments in 2026.

Do I need to apply to receive the additional $200?

No. Payments would be issued automatically.

Will the extra money affect Medicaid or SNAP eligibility?

No. The bill excludes the payment from income calculations for most benefit programs.

How much will it cost?

Official estimates are pending, but economists expect several billion dollars in temporary spending.

Is Congress likely to approve it?

The bill has support from key Democratic leaders but faces opposition from lawmakers concerned about long-term Social Security financing.