The Social Security COLA will increase by 2.8% in January 2026, the largest boost in three years, according to the Social Security Administration (SSA). December 2025 remains the final month of pre-adjustment payments, while Supplemental Security Income (SSI) beneficiaries will receive their first increased check on December 31 due to the federal holiday schedule. The adjustment reflects higher consumer prices measured during 2025.

2.8% Social Security COLA

| Key Fact | Detail / Statistic |

|---|---|

| 2026 COLA Increase | 2.8% rise in Social Security benefits |

| Average Monthly Increase | Approximately $56 for retired workers |

| First Adjusted SSI Payment | December 31, 2025 |

| Inflation Measure Used | CPI-W, Q3 year-over-year change |

| Beneficiaries Impacted | More than 71 million Americans |

| Official Website | SSA |

What the 2.8% Social Security COLA Means for 2026

The 2.8% cost-of-living adjustment affects over 71 million Americans receiving retirement, disability, and survivor benefits. The SSA announced the increase after third-quarter inflation data showed steady price growth driven by higher housing, energy, and medical costs.

In its official statement, the agency said the adjustment “helps protect beneficiaries from losing purchasing power during periods of rising consumer prices.”

Economists say the COLA serves as a critical lifeline in a year when inflation has moderated but remains elevated in essential categories for older Americans.

Breakdown by Beneficiary Category

According to SSA projections:

- Retired workers: Average benefit rising by $56 to about $2,045 per month.

- Disabled workers: Payments increasing by roughly $45 on average.

- Survivor beneficiaries: Increases vary based on household structure, with widowed spouses and children experiencing differing adjustments.

- SSI recipients: Maximum federal benefit rising from $943 to approximately $969 for individuals.

The changes will support households that rely heavily on monthly benefits. Nearly 40% of retirees depend on Social Security for half their income, according to the Center on Budget and Policy Priorities (CBPP).

December Payments Remain at 2025 Levels

Despite anticipation for higher payouts, December 2025 checks will reflect current benefit amounts, following the established payment schedule based on recipients’ birth dates.

SSA spokesperson Mark Hinkle explained that updated benefit amounts will appear “in the first regular payment of January 2026,” except for SSI recipients who receive their checks early.

Why SSI Payments Arrive Early

January 1 is a federal holiday, meaning government operations—including benefit processing—pause for the day. To avoid disruption:

- SSI payments for January are issued December 31.

- This payment includes the COLA increase.

- Recipients will still receive one payment for January despite the earlier date.

The SSA emphasizes that two December disbursements do not represent a “bonus” or “double payment”—only a scheduling adjustment.

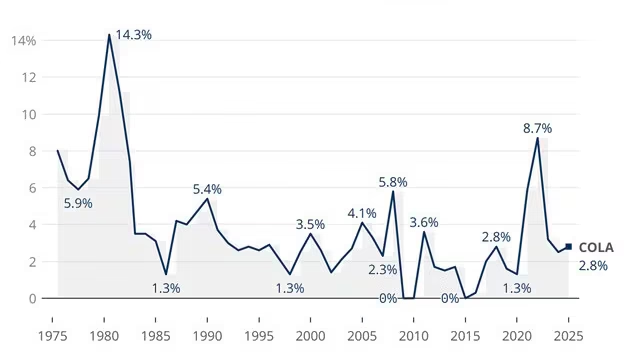

Historical Context Behind the 2026 2.8% Social Security COLA

The 2.8% increase marks a moderate adjustment compared with the unusually high COLAs of 2022 and 2023, which rose 5.9% and 8.7% respectively during a period of record inflation.

Since cost-of-living adjustments were first implemented in 1975, COLAs have ranged from 0% (during years of minimal inflation) to 14.3% in 1980.

Inflation patterns heavily influence COLA size, but critics argue that the CPI-W does not accurately reflect the spending habits of older adults. Seniors spend proportionally more on medical care and housing, categories with faster price growth than the broader index.

The Government Accountability Office (GAO) has periodically recommended exploring alternative inflation measures better aligned with retiree expenses. However, changing the CPI-W requires congressional action.

Why the COLA Increase Matters Amid Rising Living Costs

For many older Americans, the 2.8% increase provides modest relief in a year when essential expenses continue rising.

Healthcare and Prescription Costs

The Kaiser Family Foundation reports ongoing increases in Medicare Part D premiums and out-of-pocket prescription costs. Medicare Part B premiums for 2026 have not yet been finalized, but analysts expect at least a small increase, which may absorb part of the COLA for many beneficiaries.

Dr. Linda Ramirez, an economist at the Center for Retirement Research at Boston College, said:

“COLA adjustments help stabilize purchasing power, but for many households facing persistent medical inflation, the increases often fail to cover actual cost growth.”

Housing and Utility Pressures

Older adults who rent or rely on paid caregiving services face additional cost burdens. The U.S. Department of Housing and Urban Development reports that senior rental costs have risen 4–6% in many metropolitan areas.

Winter utility bills are also expected to increase, according to the U.S. Energy Information Administration.

Beneficiary Scenarios: Who Gains the Most?

The impact of the COLA varies depending on household structure, income, and expenses.

Scenario 1: Single Retiree Living on Fixed Income

A retiree receiving $1,800 per month would see an increase of approximately $50. If Medicare premiums rise, the net gain may shrink.

Scenario 2: Disabled Worker Supporting a Dependent

A disabled adult receiving SSDI with a child beneficiary may see a combined increase of $65–$75, offering meaningful support for household expenses.

Scenario 3: Low-Income SSI Recipient

For individuals relying solely on SSI, even a small increase may help offset rising food and transportation costs.

How the COLA Affects the Social Security Trust Funds

While the COLA does not directly change the long-term solvency of the Social Security trust funds, higher benefit payments increase overall program costs.

The Congressional Budget Office projects that the combined trust funds could face depletion by the mid-2030s without congressional action. Potential reforms include payroll tax adjustments, benefit formula changes, or raising the full retirement age.

Dr. Aaron Feldman of the Brookings Institution said:

“COLA increases are essential for maintaining purchasing power, but they also highlight the broader fiscal challenges facing the program.”

Demographic Trends Shaping Social Security’s Future

America’s population is aging rapidly. By 2030, all baby boomers will be age 65 or older, increasing demand for Social Security and Medicare.

Key demographic shifts include:

- A lower worker-to-beneficiary ratio.

- Increased longevity raising lifetime benefit costs.

- Slower population growth reducing payroll tax revenue.

These trends make accurate COLA calculations increasingly important for maintaining the program’s real value.

How Recipients Can Verify Their Updated Benefits

Beneficiaries can view their new payment amounts via their my Social Security accounts. Notices will also be mailed throughout December.

What the Notice Includes

- Updated monthly benefit

- Medicare Part B premium (if applicable)

- Any deductions or adjustments

- Estimated annual earnings limits for working beneficiaries

Financial planners recommend reviewing these details early to adjust budgeting for 2026.

Why December’s Social Security Schedule Is Changing — What Beneficiaries Should Expect

Looking Ahead to January 2026

The SSA will finalize January payments in early January. While the COLA provides short-term support, policymakers continue debating long-term reforms needed to sustain Social Security benefits for future generations.

Advocacy groups are urging Congress to consider benefit enhancements for low-income seniors, while fiscal conservatives are calling for structural reforms to address program solvency.

For now, beneficiaries can expect modest but meaningful increases as the new year begins.

FAQs About 2.8% Social Security COLA

1. How is the Social Security COLA calculated?

The SSA bases the adjustment on the third-quarter Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), measured year over year.

2. Does the COLA affect taxes on benefits?

Yes. Higher benefits may increase taxable income depending on household earnings and filing status.

3. Will Medicare premiums reduce my COLA increase?

Possibly. If Medicare Part B premiums rise for 2026, they may reduce the net increase beneficiaries receive.

4. Do all recipients receive the COLA at the same time?

No. SSI recipients receive the adjustment earlier due to holiday scheduling, while other Social Security beneficiaries see increases in January.

5. Does the COLA endanger Social Security’s trust funds?

Not directly, but higher benefit payouts do contribute to the program’s long-term cost pressures.